We know brick & mortar businesses have been concerned about the move to digital and have been going through significant structural shift in 2018 to stay relevant. This has caused existential concerns for many UK Retailers with some household names sadly now in administration, bankrupt, or closed.

Predominately online businesses had been immune to the high street carnage with quarterly results pushing share prices to all-time highs. But in mid-December ASOS, the online powerhouse, issued a profit warning resulting in stock price tumbling 40%. Bloomberg underlined this apocalyptical warning and reported a significant deterioration in November sales for online retailers. Sports Direct CEO Mike Ashley even called it an ‘unbelievably bad’ November.

Causes for the Retail Sector’s Downtrend

From a demand perspective, high levels of consumer debt, interest rate rises, and concerns about the UK political situation are all having an impact on consumer confidence. Adding to this, clothing retailers are sharing that unpredictable weather is playing a part in demand, forecasting and inventory. The summer has been incredibly warm in most parts of Europe and people were preferring enjoying the beaches to going shopping (offline and online).

If you factor in the increase in costs – wages, rates, materials rising due to the weakness in Sterling – fierce competition, and consumers’ addiction to discounts, you can start to understand why many journalists are calling this an apocalypse.

So, do UK retailers need to fear the future? Are consumers going to decrease consumption or are they going to spend their money elsewhere? It is hard to answer that question in a general way, especially with a never-before-scenario like Brexit causing uncertainty. What may be true for some brands and products will not be true for others. It is important to look at the whole picture and see what macro- and micro-economic factors are having an impact on your business.

Promotions Have Lost Their Punch

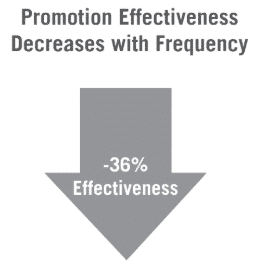

One factor that is most certainly having an impact on buying habits are promotions. We have discussed the issue of high volume and depth of promotions in our recent ROI Genome report “Have Promotions Lost Their Punch?”. For the retail industry, which leverages promotions through all seasons, this might be bad news: promotions, as they were used in the past, have lost their ROI advantage versus advertising.

Just take a look back at the holiday season 2018: Black Friday, spread from the US into the European market a couple years ago, is meant to be THE sales day of the year. But for 2018, loads of retailers have underperformed for what can for the most part be traced back to two simple reasons we have uncovered from our data:

Consumers are becoming oversaturated with deals. We see this in terms of both breadth but also depths of discounts, and across promotional vehicles. Whether it be couponing, email offers or offers on shelf, the same trends hold true: as consumers are inundated with more and deeper deals, each one becomes less compelling. See example to the right: as promotion frequency increased, effectiveness decreased – with a 36% drop in effectiveness with promotions happening every other week.

The rise of technology and smart phones has enabled more transparent pricing. A more sophisticated consumer is able to compare prices and understand actual value of promotions, ultimately reducing any scarcity effect and perceived value of a deal.

Marketeers need to understand that the consumer has evolved and is a lot more educated through adaptation to constant promotional offers (overuse) and the all-knowing, all-comparing internet. Consumers spend less because they are not as impressed by special deals and offers anymore. They know where to find the cheapest offer during multi-offer-times like Black Friday or where to find the same product for a cheap price all year long.

Give Your Company a Marketing Makeover

Having said all this, there is a thick silver lining on the retail horizon: first Christmas sales reviews reveal a slight rise in sales for fashion retailers, although overall it remains a tough year for UK retailers. And there are success stories like Altrincham’s ghost town to boom town in less than 10 years and some online businesses allocating marketing spend to TV and print and not just relying on PPC and affiliates. In fact, two of the biggest TV advertising spenders in the US this holiday season are Amazon and Google – companies synonymous with digital.

Retail is not dead. In fact, people will not stop spending their money on consumer goods and clothing from one day to the other. They will adapt to new economic trends, just like fashion adapts to new trends. Whether you are an online, omnichannel or pure Brick & Mortar retailer, understanding and measuring all these variables in a Unified approach will help you stay ahead of the curve and maximise your marketing spend even in times of uncertainty and changing consumer behaviour. And isn’t that what fashion is all about anyway: being en vogue?